Present value of a stream of payments

Stands for the amount of each annuity payment r. Assume that your business will receive a 10000 payment 3 years from now.

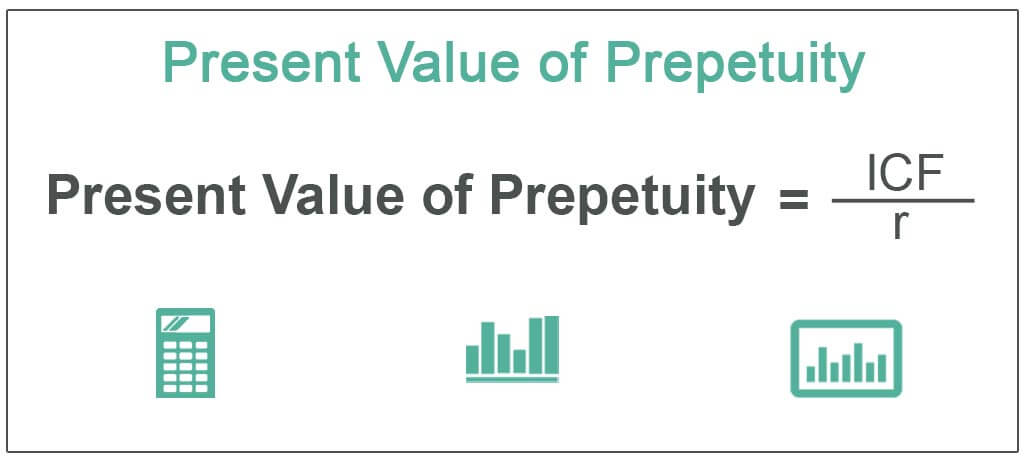

Present Value Of Perpetuity How To Calculate It Examples

Determining the appropriate discount rate is the key to properly.

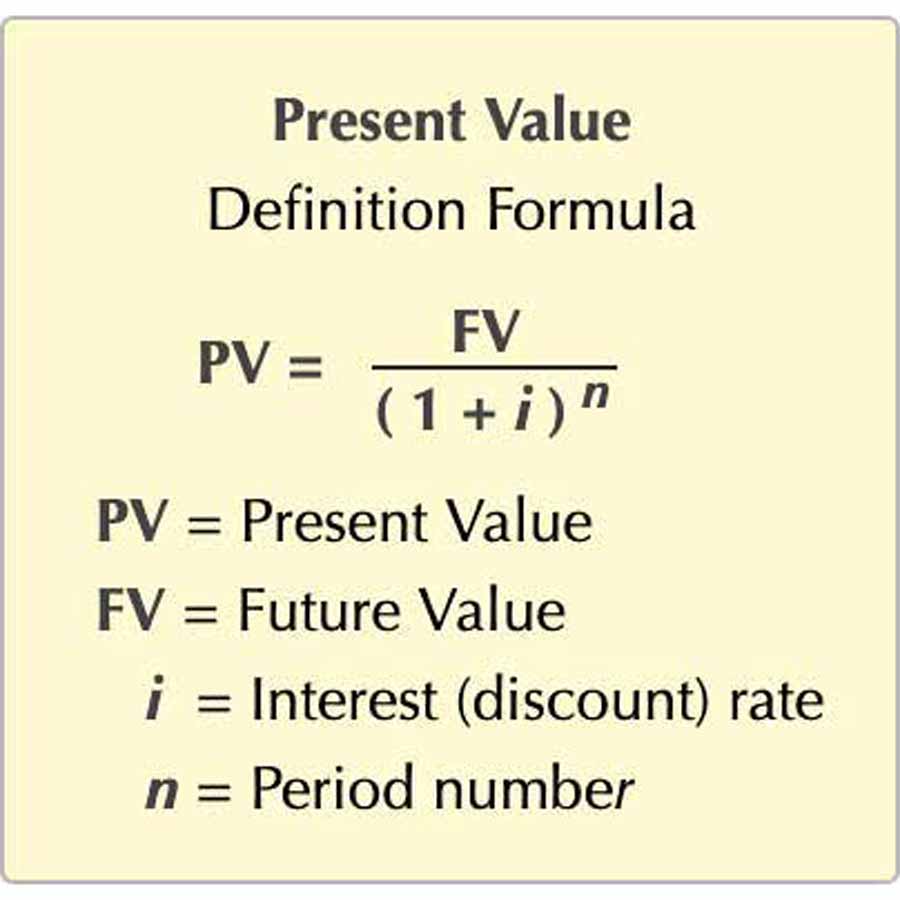

. Calculate the present value with interest rate 5. The present value PV is what the cash flow is worth today. The present value of an annuity is the current value of future payments from that annuity given a specified rate of return or discount rate.

I 5 100 005. The present value annuity calculator will use the interest rate to discount the payment stream to. PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return.

Present value also referred to as PV of lease payments is a financial calculation that measures the worth of a future sum of money. Future cash flows are discounted at the discount rate and the higher the discount rate the lower the present value of the future cash flows. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return.

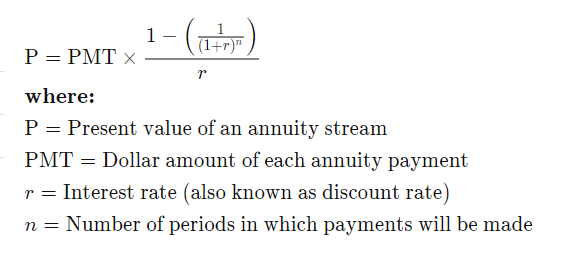

The formula for calculating the present value of an ordinary annuity is. Present value then is a summation. Our online calculators and mobile app are a must-have for anyone involved in the field of personal injury claims.

P The present value of the annuity stream to be paid in the future. The uniform amount annuity paid from a 7 years project is 5000. The present value of the maturity amount will be calculated next.

Future cash flows are discounted at the discount. Present Value of Pension Options. This method takes a future payment and uses discounting to determine the future payments present value.

Present value of an annuity is finance jargon meaning present value with a cash flow. You assume an interest rate also called a discount rate of 5. 5000 it is better for Company Z to take Rs.

More Future Value of an Annuity. Stands for the Interest Rate n. Present Value - PV.

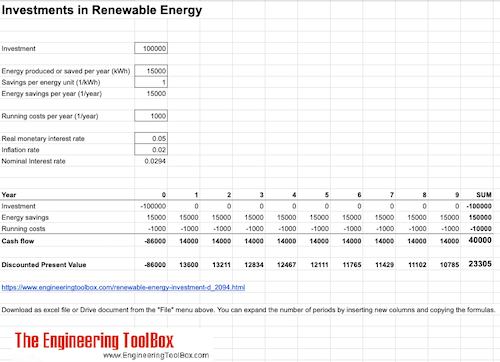

A popular concept in finance is the idea of net present value more commonly known as NPV. More specifically you can calculate the present value of uneven cash flows or even cash flows. Find the present value.

Calculate the net present value NPV of a series of future cash flows. What is the Present Value of Lease Payments. When using the present value tables use the semiannual market interest rate i and the number of semiannual periods n.

Note that this present value method assumes compounding interest annually. N The number of periods over which payments are to be made. If you are married you ought to consider joint life expectancy in your calculations.

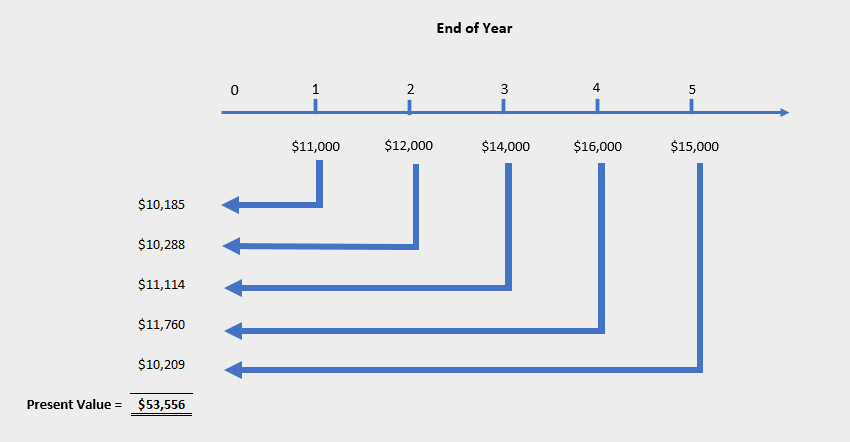

Present value is the concept we hinted to above - the value of a stream of future payments discounted by the conditions in the market today. Recall that this calculation determined the present value of the stream of interest payments. With our Occupier present value.

Future Value Face Value. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. As present value of Rs.

The value of the coin you choose can change instantly without notice and unfortunately the estimate you expect may differ from the actual amount you receive. Present value of lease payments explained. The cash flow may be an investment payment or savings cash flow or it may be an income cash flow.

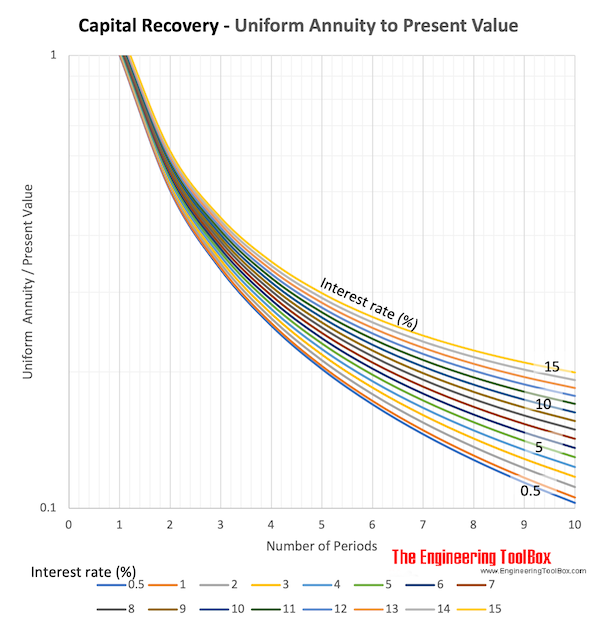

Present value commonly referred to as PV is the calculation of what a future sum of money or stream of cash flows is worth today given a specified rate of return over a specified period of time. Example - Present Value of Uniform Amounts. Explanation of PV Factor Formula.

Present Value of a Bonds Maturity Amount. A present value calculation is also an effective way to compare different pension choices. Stands for the number of periods in which payments are made The above formula pertains to the formula for ordinary annuity where the payments are due and made at the end of each month or at the end of each period.

Thus this present value of an annuity calculator calculates todays value of a future cash flow. P PMT 1 - 1 1 rn r Where. Stands for Present Value of Annuity PMT.

The Paxum account must be verified with Paxum in order to receive payments. PMT The amount of each annuity payment. The volatility of crypto is an ever-present characteristic in the coin market.

Download and print Present Value of Uniform Annuity chart. A future sum of money being a stream of payments given a specified return rate over a given time according to My Accounting Course. As you can see in the above screenshot.

P The future value of the annuity stream to be paid in the future PMT The amount of each annuity payment r The interest rate. 5500 after two years is lower than Rs. R The interest rate.

These tools provide a quick and easy way to calculate life expectancy immediate present value and the current value of a past Court award. The present value of the uniform amounts can be calculated. See Present Value Cash Flows Calculator for related formulas and calculations.

Under the new lease accounting standards lessees are required to calculate the present value of any future lease payments. Annual Interest Rate This is the interest rate earned on the annuity. If you anticipate a long life expectancy one option may be worth more to you in terms of present value than another option.

P PMT 1 rn - 1 r Where. The Present Value Formula PV is of course the present value formula. Interest Rate discount rate per period.

Present value means todays value of the cash flow to be received at a future point of time and present value factor formula is a toolformula to calculate a present value of future cash flow. This is a stream of payments that occur in the future stated in terms of nominal or todays dollars. The formula for calculating the future value of an ordinary annuity where a series of equal payments are made at the end of each of multiple periods is.

The interest rate can be calculated.

Understanding Present Value Formulas Propertymetrics

Using Pv Function In Excel To Calculate Present Value

Present Value Of Annuity Calculator

Present Value Of An Annuity How To Calculate Examples

Present Value Of Annuity Calculation Knime Analytics Platform Knime Community Forum

Present Value Of Cash Flows Calculator

How To Calculate The Present Value Of An Annuity Youtube

How To Use Discounted Cash Flow Time Value Of Money Concepts

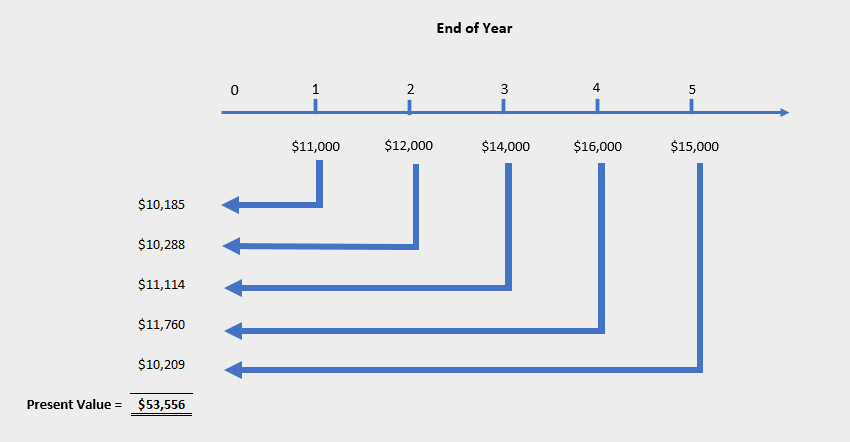

Present Value Of A Mixed Stream Cash Flow Accounting Hub

Present Value Of An Annuity How To Calculate Examples

Present Value Of A Perpetuity Formula Double Entry Bookkeeping

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

Annuity Present Value Pv Formula And Calculator Excel Template

Present Value Of Annuity Due Formula Calculator With Excel Template

/presentvalue_final-25e185ad099a40ce817849fb2cec085e.jpg)

Jm Llv7kqnq48m

Net Present Worth Npw Of A Cash Stream

Net Present Worth Npw Of A Cash Stream